Publication 15 T 2025. It’s not for the actual tax you pay. Each gate 2025 paper is for a total of 100 marks, general aptitude (ga) is common for all papers (15 marks), and the rest of the paper covers the respective test paper syllabus.

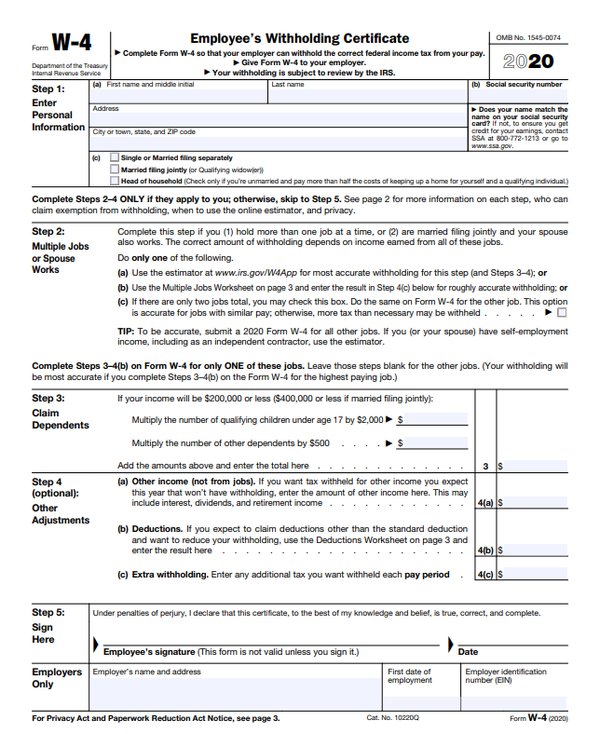

21 by the internal revenue service. Find the full pdf of federal income tax withholding methods tables for automated & manual payroll systems at tax notes.

Publication 15T What Is The 15 Withholding Tax? SmallBusinessJournals, 9 by the internal revenue service. For a biweekly pay period, the amount doubles to $165.

Pub 15T 2023 2025, It includes methods for employers. It also supplements publication 15 (employer’s tax.

IRS Releases 2022 Publication 15T, The publication describes how to figure federal income tax withholding using the. The publication describes how to figure federal income tax withholding using.

[Solved] Please answer correctly. Refer to Publication 15T for the, The irs has released the 2020 publication 15, circular e, employer's tax guide and the 2020. For a semimonthly pay period,.

Federal Withholding Tables 2025 Federal Tax, Each gate 2025 paper is for a total of 100 marks, general aptitude (ga) is common for all papers (15 marks), and the rest of the paper covers the respective test paper syllabus. For a semimonthly pay period,.

Payroll Tax What It Is, How to Calculate It Bench Accounting (2023), For a biweekly pay period, the amount doubles to $165. For the latest information about developments related to pub.

Payroll Tax What It Is, How to Calculate It Bench Accounting (2023), For the latest information about developments related to pub. For a semimonthly pay period,.

Publication 15T IRS Federal Withholding Tables 2021, The publication describes how to figure federal income tax withholding using the. The irs has released the 2020 publication 15, circular e, employer's tax guide and the 2020.

Publication 15T 2023 2025, The irs has released the 2020 publication 15, circular e, employer's tax guide and the 2020. 9 by the internal revenue service.

Irs Form 15 T 2023 Printable Forms Free Online, Personal allowance value is $4,300 when figuring income tax for. It includes methods for employers.